Your Local Surrey Insurance Brokers

Best Insurance Broker in Surrey, British Columbia

Based in Surrey, our insurance company believes in building lifetime relationships with our valued customers. Our team of qualified, experienced, and trusted brokers treat our customers as members of our large and ever-expanding family. Our educated and highly skilled staff will evaluate and help you in selecting the best coverage, which also can be customized to suit your needs. We believe in only providing our clients the best products from only the best insurance companies. We have been serving the lower mainland for the past 5 years and have established our trust within the community. We plan on expanding this trust all across Canada in the near future.

We stand by our core values of professionalism and integrity and we are committed to continuously improve the quality of the service we provide you.

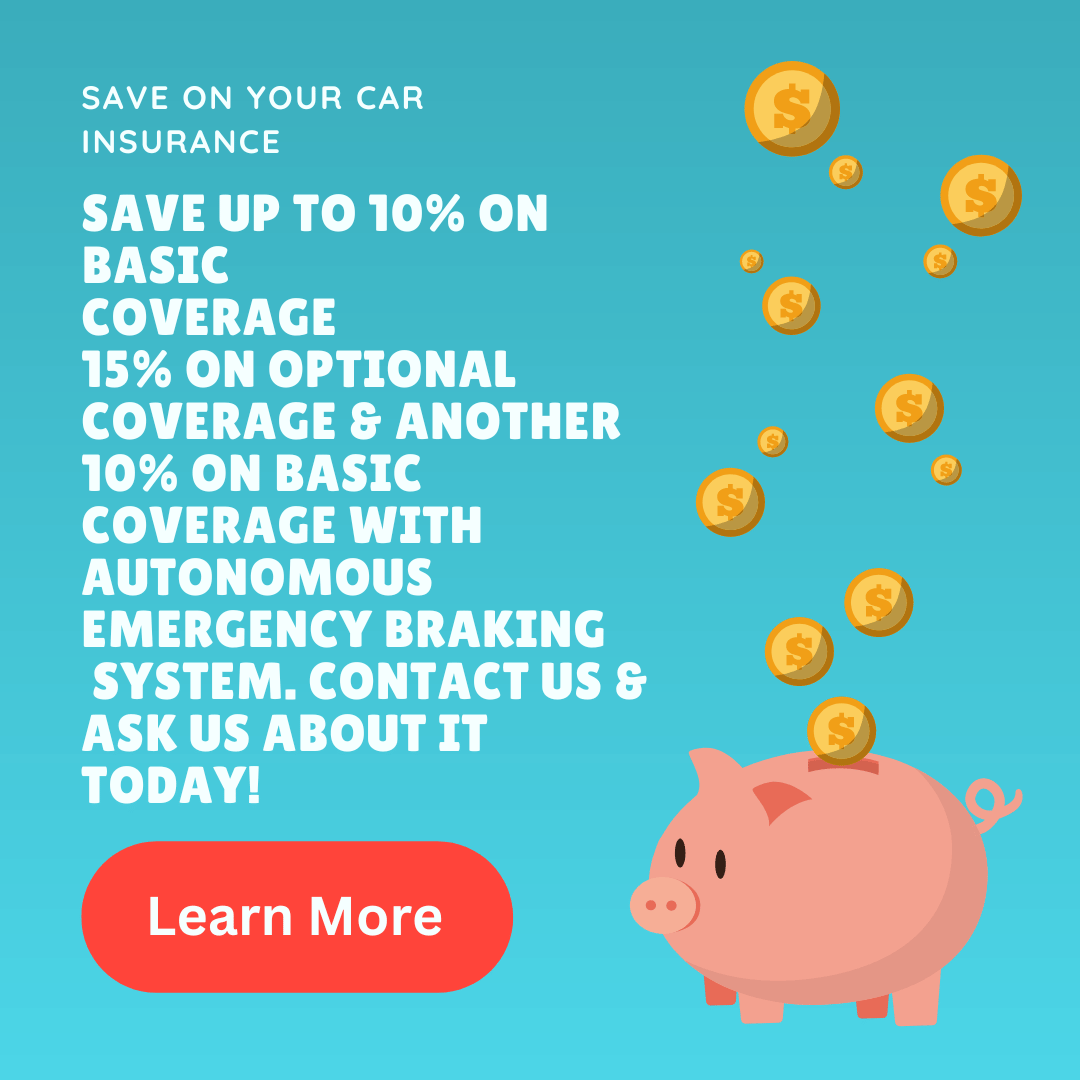

We Make It Easy For You To Save $$$ When Renewing Your Auto Insurance

Choose From One Of Our Five Convenient & Flexible Options:

By Phone

Call us during our office hours to renew or make changes to your ICBC Autoplan Insurance.

By Appointment

Book a time that is convenient with your schedule. One of our agents will contact you to renew your ICBC Autoplan Insurance.

In Person

Come visit us at our office and you can renew your plan in person.

Renew Online

Fill out our Renew Online form and someone will contact you to renew your plan.

Skip A Trip App

Use our handy app for iOS and Android to Renew.

Goldleaf Insurance

Home

Auto

Commercial

Life

Insurance Built Around

your Needs and Requirements

At Goldleaf Insurance, we understand that your home is your most valuable asset and that is why we want you to have a coverage that protects your home, family, possessions, and valuable assets. Goldleaf provides variety of insurance coverages

Goldleaf Insurance Services

At Goldleaf Insurance, we are a Surrey insurance office committed to providing financial security to protect you, your family, and your business. Our knowledgeable team of brokers specialize in selecting the best insurance policy to meet your individual needs. The expertise and dedication from our team of brokers has earned us a reputation for excellence and helped us gain a wide-spread list of clients throughout British Columbia. Whether you are located in Surrey, Vancouver, or another area of the Lower Mainland, our insurance brokers provide protection so that your insurance needs are covered. With personal and commercial insurance plans, Goldleaf can keep your family, vehicles, and business protected.

Life Insurance

Keep yourself and your loved ones protected with personal life insurance. A death is a devastating loss, and without adequate insurance coverage, the aftermath can be even more strenuous. While a family copes with grief, they should not have to bear the weight of financial instability. Ensure your loved ones are covered for living expenses, education, childcare, debts, mortgage costs, and more, with personalized life insurance.

Auto Insurance

Choose the best insurance coverage for your vehicle. Whether it’s the damage to your car, injuries suffered by you or your passengers, or worse, a collision can be a traumatic event. To ensure all your insurance needs are covered, our Surrey insurance advisors go the extra mile. From liability, collision, and comprehensive car insurance to emergency roadside assistance and more, Goldleaf has the insurance solutions to protect you and your vehicle.

Commercial Insurance

Protect your business from liability, unexpected losses, and financial risk with an insurance policy tailored to your needs. An integral part of any business in Surrey, British Columbia, a Goldleaf insurance broker can advise on the best providers of commercial coverage. Whether you need insurance for commercial general liability, course of construction, farming, or cargo, we offer full range insurance services to protect your business.

Commercial Auto Insurance

Do you rely on a set of wheels to run your business? Whether you run deliveries, offer ride-hailing services, or need protection for your garage service operations, you deserve an insurance buying experience that is tailored to your needs. From cars, trucks, and vans to commercial trailers and large fleets, we can get you the commercial coverage you need to keep your business running smoothly.

Manage Your Insurance

An entity which provides insurance is known as an insurer, insurance company, or insurance carrier. A person or entity who buys insurance is known as an insured or policyholder. The action involves a contract.

- Home

- Commercial

- Life

- Auto

Find An Agent

The insurance transaction involves the insured assuming a guaranteed and known relatively small loss in the form of payment to the insurer in exchange for the insurer’s promise to compensate the insured in case of a covered loss.

Need Help? Call Us Now !

Do you Know?

An entity which provides insurance is known as an insurer, insurance company, or insurance carrier. A person or entity who buys insurance is known as an insured or policyholder. The action involves a contract. From an insured’s standpoint, the result is usually the same: the insurer pays the loss and claims expenses.

Auto Insurance Surrey

If you’re a driver in British Columbia (BC), it’s essential to have top-quality auto insurance coverage to protect you, your family, and your assets. With over 250,000 automobile collisions occurring in BC each year, getting the right car insurance plan is crucial. Whether you’re driving every day or embarking on a long journey, you need to ensure that you’re protected. That’s where a Surrey car insurance broker can help. Our team at Goldleaf Insurance can help you find the best coverage at the best rates. We care about your well-being and are here to help you get the protection you need.

Contact Us Today For Auto Insurance in Surrey

More about auto insurance

Surrey Basic Autoplan

Auto insurance is a mandatory requirement for all drivers in British Columbia. The ICBC Basic Autoplan is the minimum level of coverage required by law to operate a vehicle in BC. It provides mandatory coverage for third-party liability, accident benefits, and uninsured motorist protection. These coverages are designed to protect you in the event of an accident, regardless of who is at fault. Coverage includes:

- Third-party liability coverage is the most critical component of ICBC Autoplan. It provides coverage if you are responsible for injuring someone else or damaging their property.

- Accident benefits cover medical costs and rehabilitation if you are injured in an accident/ collision.

- Uninsured motorist protection provides coverage if you are involved in an accident with an uninsured driver.

While the ICBC Autoplan provides the minimum level of coverage required by law, it is important to note that it may not be enough to fully protect you in the event of an accident. Additional coverage options, such as collision and comprehensive coverage, can provide extra protection for your vehicle.

At Goldleaf Insurance, our insurance brokers understand the importance of being protected on the road. We are committed to finding the best auto insurance policy to meet your needs and budget. Contact us today so we can learn more about your insurance needs and ensure you’re covered on the road.

ICBC Optional Insurance in Surrey

While the ICBC Autoplan provides the minimum level of coverage required by law, this plan may not be enough to fully protect you in the event of an accident. That’s why ICBC offers a range of optional insurance plans that can provide additional coverage for your vehicle and protect you against unforeseen circumstances.

One of the most popular optional insurance plans is collision coverage. This coverage is designed to protect you in the event of a collision with another vehicle or object. It covers the cost of repairs to your vehicle, regardless of who is at fault.

Another optional but popular insurance plan is comprehensive coverage. This coverage protects you against damage to your vehicle that is not caused by a collision. This can include damage from theft, vandalism, hail, or other natural disasters.

ICBC also offers additional liability coverage options to protect you in the event that you are responsible for causing damage to another person’s property or injuring someone in an accident.

Depending on your needs, there are many optional car insurance options available to you, including:

- Collision

- Hit and Run

- Income Top-Up

- Comprehensive

- Extended Third-Party Liability

- Extension Underinsured Motorist Protection

- Loss of Use

- Luxury Vehicle

- Specified Perils

- Rental Vehicle Coverage

- New Vehicle Protection

At our Surrey auto insurance office, we understand the importance of being fully protected on the road. That’s why we offer a variety of insurance options to meet your needs and budget. Whether you’re looking for basic coverage or additional protection, we can help you find the right ICBC Autoplan to protect you and your vehicle.

Private Optional Insurance

ICBC serves as the primary insurance provider throughout British Columbia; however, private insurance options are available for drivers in Surrey, BC. While obtaining an ICBC policy is mandatory for BC drivers, there are situations where additional auto insurance from a private company could be helpful.

One of the main benefits of private optional auto insurance is that it can offer higher coverage than the mandatory ICBC Autoplan. This means that if you are involved in an accident and are found to be at fault, you will have more coverage to pay for damages to the other person’s vehicle or property. And since private insurers can offer more flexibility with lower premiums, this could be a more affordable option than paying for additional ICBC coverage.

Additionally, private optional auto insurance can offer additional coverage options, such as rental car coverage or roadside assistance. These options can be beneficial if you rely on your vehicle for work or have a long commute. They can also cover a broader range of situations, including damage to personal property such as sound systems and veterinary bills for injured pets.

Finally, private optional auto insurance can offer more personalized service and support. When you work with a private auto insurance provider, you can get personalized advice and recommendations based on your specific needs and budget.

If you are looking for additional protection and coverage options beyond what is offered by ICBC, private optional auto insurance may be a good option for you. Since every policy is different, it’s important to clearly understand the details before signing any paperwork. To determine which plan is right for you, please get in touch with one of our brokers at our Surrey insurance office.

FAQ

Who is covered in a car insurance policy?

A car insurance policy typically covers the named insured, any listed drivers, and other individuals who have permission to drive the vehicle with the owner’s consent. The policy may also provide coverage for passengers and other individuals who are injured or suffer property damage as a result of an accident involving the insured vehicle.

How much does car insurance cost in BC per month?

The cost of car insurance in BC varies depending on several factors, including the driver’s age, driving record, and the type of vehicle being insured. According to ICBC, the average cost of car insurance in BC is $1,832 per year or $153 per month. However, rates can vary widely depending on the driver’s individual circumstances.

Is ICBC the only car insurance available in Surrey?

No, ICBC is not the only car insurance option in Surrey. While ICBC is the primary provider of basic car insurance in British Columbia, drivers in Surrey and other parts of the province can also purchase additional coverage from private insurance companies. Our auto insurance agents can help you explore your options.

Can you drive without insurance in Surrey?

No, driving without insurance in Surrey or anywhere else in British Columbia is illegal. All drivers must have a minimum level of insurance coverage, which is the basic auto plan provided by ICBC. Failure to carry insurance can result in fines, license suspension, and other penalties.

What type of car insurance should I get?

The type of car insurance you should get depends on your individual needs and circumstances. It’s best to speak with one of our insurance brokers to determine which auto plans are right for you. In addition to the basic auto plan from ICBC, drivers in BC can purchase additional coverage options, such as collision coverage, comprehensive coverage, and liability coverage.

Do you need insurance to rent a car?

Yes, you typically need insurance to rent a car. Most rental car companies offer insurance options for renters, but your personal auto insurance policy or credit card benefits may also cover you. It’s important to check with your insurance provider or credit card company before renting a car to see what coverage options are available to you.

What Our Clients Say

Our Partners

Goldleaf Insurance Brokers | Life, Auto & Commercial Insurance

Phone: (604) 591-6200

Email: info@goldleafinsurance.ca

Address: 13049 76 Avenue #102,Surrey, BC, V3W 2V7

Hours:

Monday 9 am–11 pm

Tuesday 9 am–11 pm

Wednesday 9 am–11 pm

Thursday 9 am–11 pm

Friday 9 am–11 pm

Saturday 9 am–10 pm

Sunday 9 am–9 pm